High-Frequency Event Analysis in Eurex Interest Rate Futures

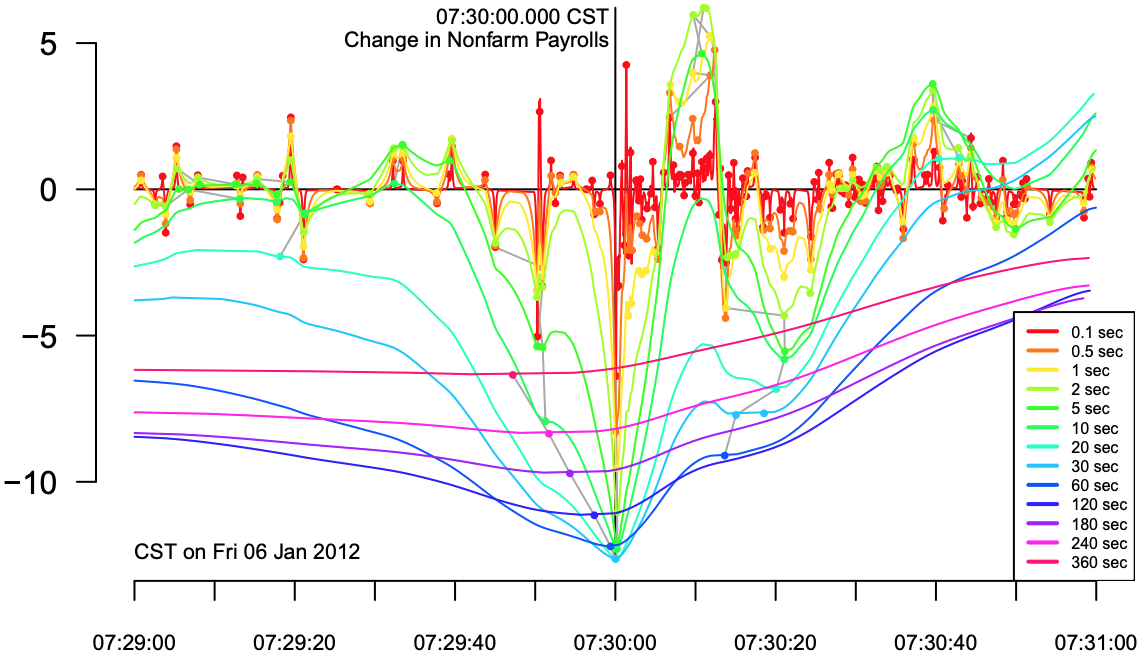

June 26, 2012 - We investigate the effect of scheduled information releases and auctions on high-frequency trading of interest rate futures on the Eurex exchange, and compare with similar products on CME. Our study differs from earlier ones in two respects. First, we use very detailed tick data rather than five-minute bars, so we are able to look for sharp price changes on times scales of one or two seconds. Second, we use a very large universe of potential events, in particular including all US and European Treasury auctions as well as economic information releases. We find that, to a degree even greater than identified in previous work, both US and European rates markets respond almost exclusively to US events: European events and auctions have almost no discernible effect. Very short-term products—Eurodollars and two-year note futures—are affected only by the US “Change in Nonfarm Payrolls” release, whereas longer-term products are affected by a broad variety of US releases.

Request the full whitepaper by filling out the form below.