November 12, 2020 - In this article, we analyze the changes in the term structure after the election. The findings are interesting as the level of VIX has dropped whereas the implied volatility term structure of options on E-mini S&P 500 futures indicates the possibility of an extreme movement.

Read MoreOctober 29, 2020 - In this paper, we use end-of-day data of VIX futures, options on E-mini S&P 500 futures and options on 10-Year Treasury to analyze the uncertainty related to the upcoming presidential election.

Read MoreOctober 8, 2020 - In this paper, we propose a simple model for summarizing historical trade performance in futures markets.

Read MoreAugust 31, 2020 - In this research, we compare the microstructure variables of ASX 3-Year and 10-Year calendar spreads during the September roll period against the previous roll periods.

Read MoreSeptember 24, 2020 - In this paper, we apply the causal forest, a semi-parametric estimator for causal effects, to identify the impact—precisely, the partial effect—of order and trade size on price, as well as how these impacts vary with market conditions.

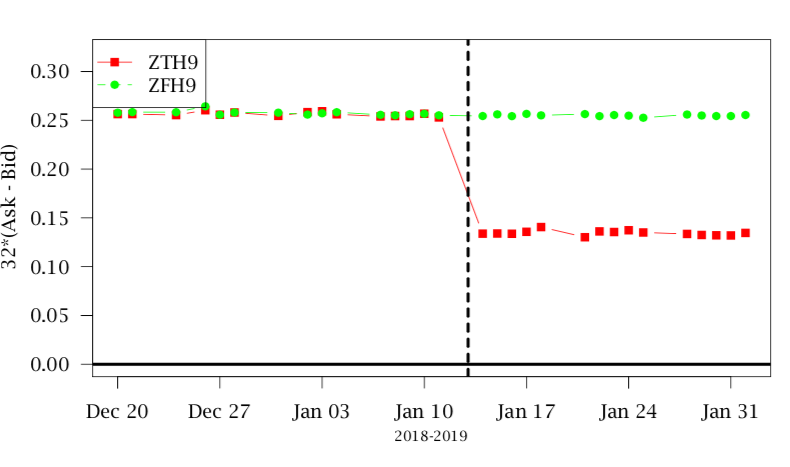

Read MoreAugust 31, 2020 - In this paper, we analyze the potential impact of tick size (minimum price increment) changes for the upcoming ASX roll period. ASX will reduce the tick size of the 3-Year and 10-Year interest rate futures during the 5 days of the roll period in September 2020. Specifically, the 3-Year tick size will go from 1/2𝑛𝑑 to 1/5𝑡h basis point, and the 10-Year tick size will change from 1/4𝑡h to 1/10𝑡h basis point during the roll period.

Read MoreAugust 21, 2020 - In this white paper, we introduce the notion of implied quotes to address this problem and also present a fast approximation algorithm to generate the best prices of implied quotes in real-time.

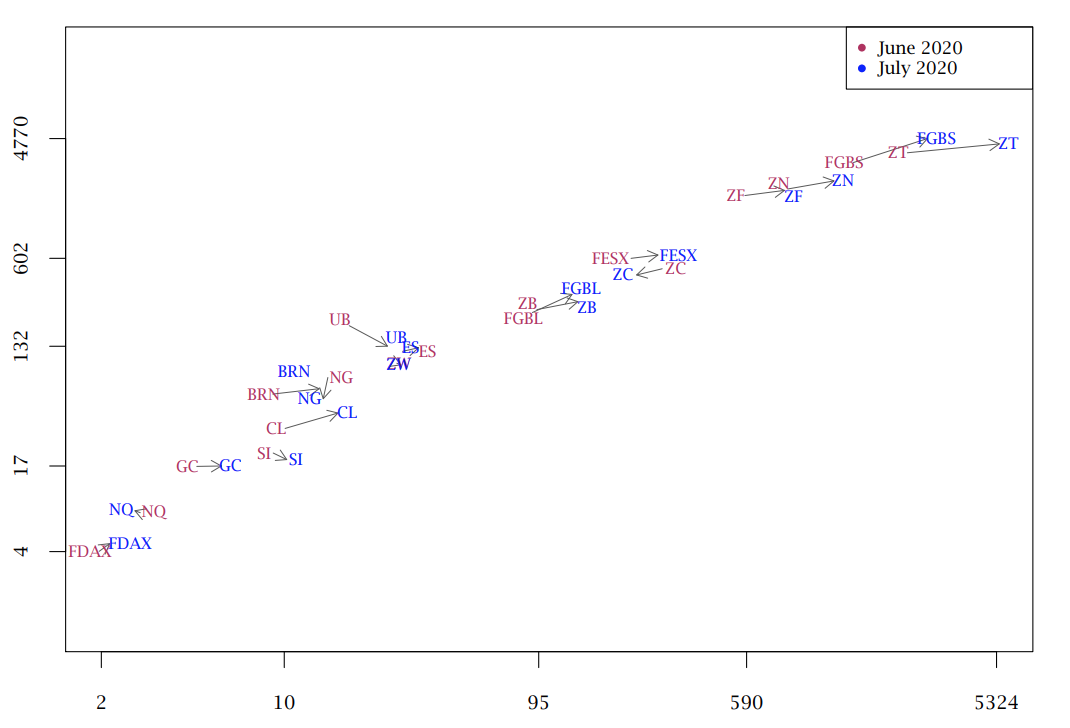

Read MoreAugust 7, 2020 - We look at the most traded symbol for several instruments across different exchanges to report the average daily quote size and liquidity of July 2020. We compare the same against the liquidity and quote size of June 2020 as well as July 2019.

Read MoreApril 24, 2020 - During March 2020, market volume and volatility increased dramatically, because of the uncertainty about the economic impact of the Covid-19 virus.

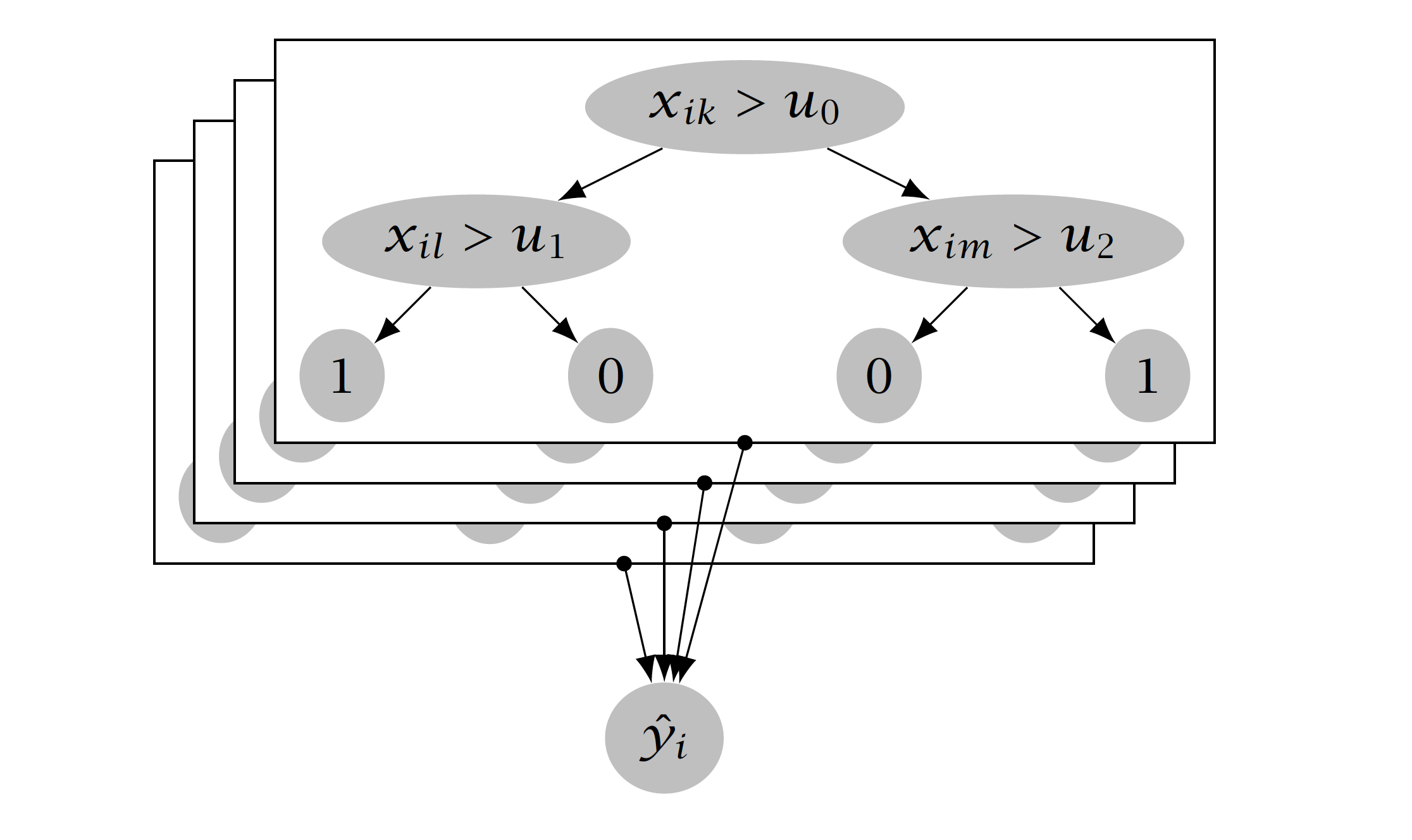

Read MoreMarch 23, 2020 - QB’s research to identify regimes using multidimensional inputs and machine learning to optimize execution. Our methodology provides a blueprint for how to combine algorithmic strategies to drive down costs even in challenging times.

Read MoreOctober 14, 2019 - While certainly not the case with every order, frequent liquidity takers in the CME’s options on futures markets are likely familiar with “vanishing liquidity.”

Read MoreJuly 29, 2019 - The topic of cointegration is not new to finance literature. The hypothesis of cointegrated bond prices has been thoroughly examined by several authors.

Read MoreApril 25, 2019 -When using algorithms to work meta-orders on electronic markets, traders often want to place controls on the algorithm in order to limit the market impact.

Read MoreApril 23, 2019 - Trade-at-Settlement (TAS) on the CME is a listed futures instrument. It permits market participants to trade at a differential to the underlying futures, current day, not-yet-known settlement price.

Read MoreNovember 15, 2018 - We continued our previous study and this time we describe additional variables added to forecast the ten days of the roll period, we also outline our multivariate model used in our forecasts.

Read MoreJune 12, 2018 - Cash Treasuries, unlike most products traded by QB, are available to trade on multiple venues.

Read MoreApril 10, 2018 - Market microstructure and liquidity profiles have important implications for the price impact and slippage of client orders.

Read MoreJanuary 16, 2018 - In recent years, the topic of price or economic bubbles has received significant attention.

Read MoreFebruary 10, 2017 - Implied quoting is a characteristic feature of interest rate futures markets.

Read MoreJanuary 13, 2017 - Price impact caused by an aggressive order is a staple of market microstructure research.

Read More