January 13, 2017 - Price impact caused by an aggressive order is a staple of market microstructure research.

Read MoreDecember 15, 2018 - Price impact caused by an aggressive order is a staple of market microstructure research.

Read MoreNovember 12, 2016 - We are often asked at QB if algorithms are always better than humans. It might surprise the reader that we don’t see this as an “us” vs “them”.

Read MoreSeptember 15, 2016 - Hidden liquidity is resting volume available in the order book, that is not visible in market data but that can be traded against by a suitable marketable order.

Read MoreNovember 4, 2016 - QB’s execution simulator is an important tool for developing and evaluating our algorithms.

Read MoreSeptember 14, 2016 - In response to strong client demand, Quantitative Brokers (QB) has developed a new algorithm called Closer benchmarked to the daily settlement price.

Read MoreFebruary 12, 2016 - Algorithmic futures trading has recently become very popular among the world’s largest commodity trading advisors (CTAs), global macro hedge funds, pension funds and asset managers.

Read MoreAugust 6, 2015 - Different futures products show markedly different distributions of activity across contract months.

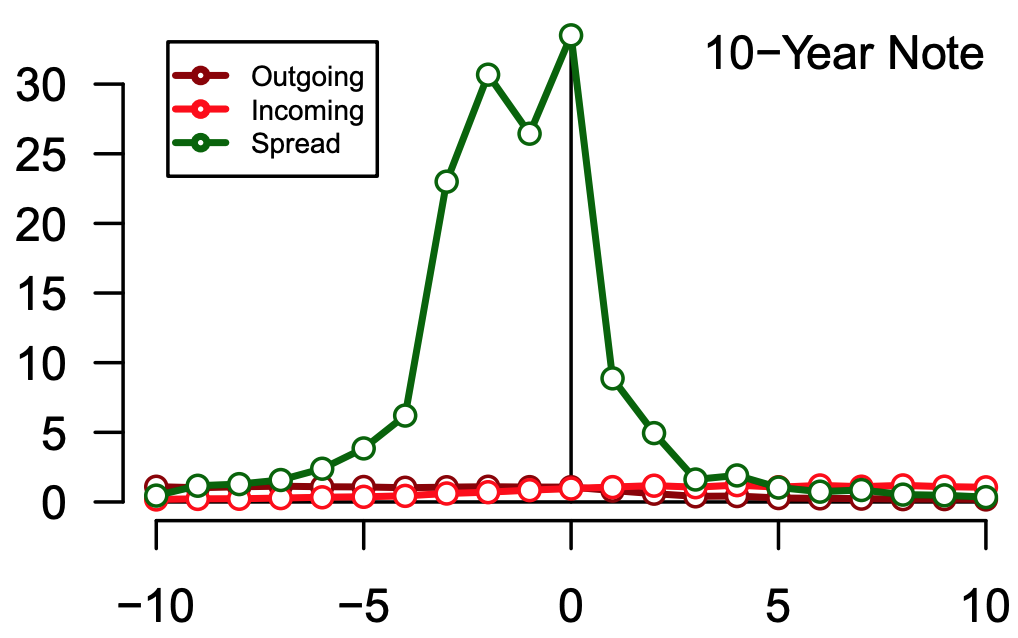

Read MoreJune 18, 2015 - On the morning of October 15, 2014, between 9:35 and 9:45 New York time, yields on US Treasury securities underwent their largest single-day drop since 2009, and quickly recovered.

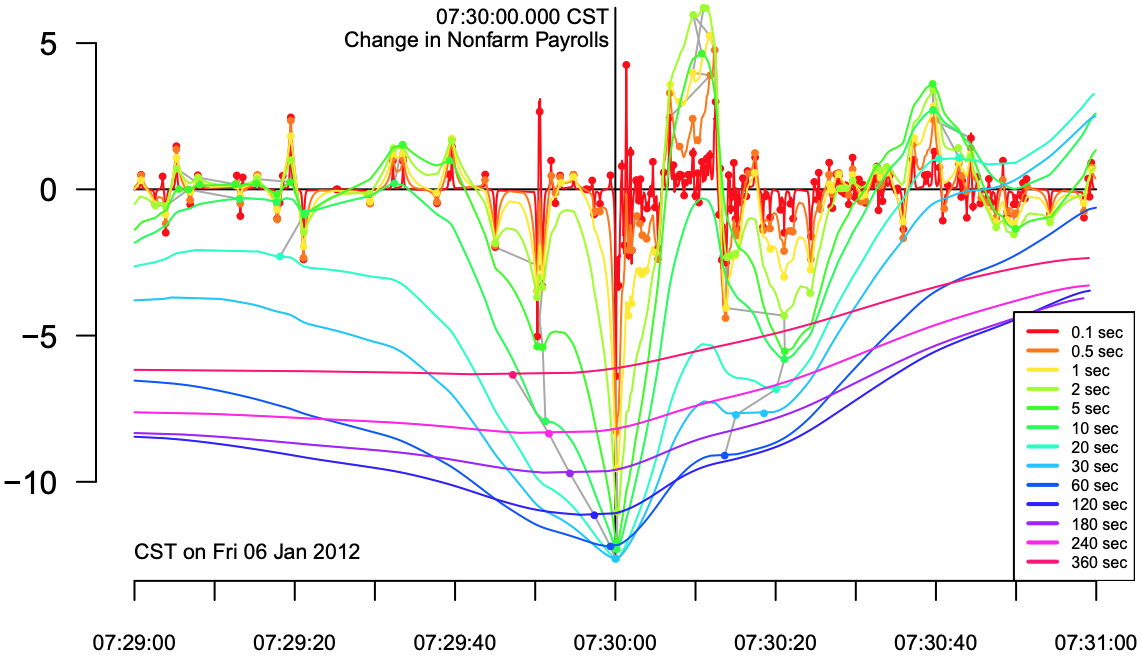

Read MoreJune 11, 2015 - We track 62 unique macroeconomic events and calibrate our volume forecasts to the effect of each data release.

Read MoreJune 9, 2015 - A brief report in the context of the June 9 WSJ article, which discusses a decline in the bids to debt ratio of the 10-year Gilts.

Read MoreMay 30, 2014 - Overall volume has been steadily increasing following a low point at the end of 2008.

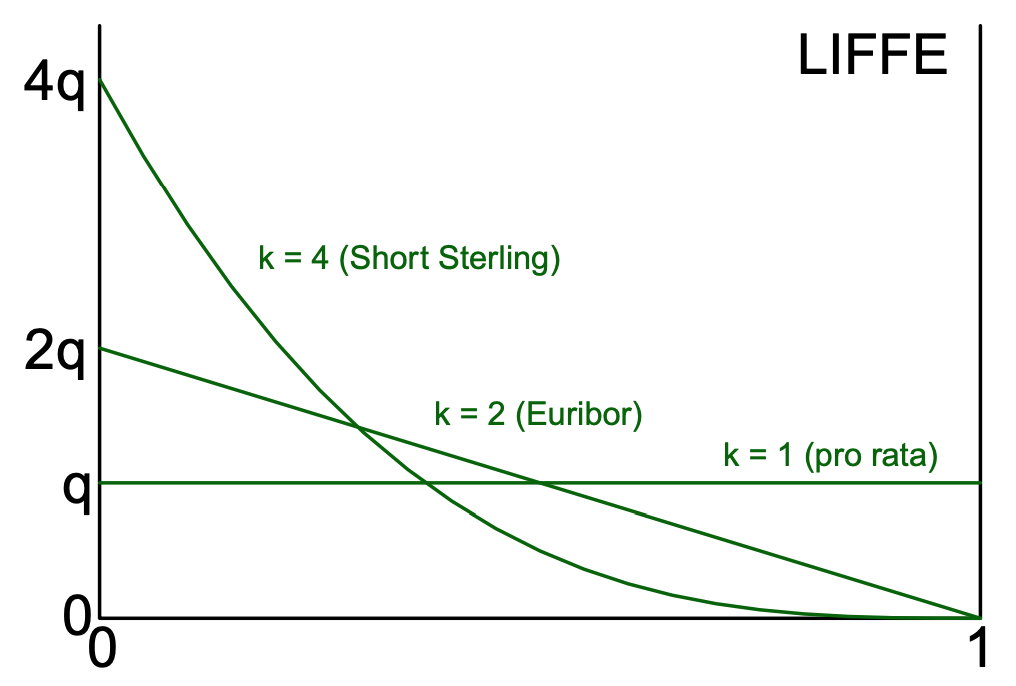

Read MoreMay 31, 2013 - Effective May 29, 2013, the NYSE LIFFE exchange announced a change to the pro rata trade matching algorithm.

Read MoreJune 26, 2012 - We investigate the effect of scheduled information releases and auctions on high-frequency trading of interest rate futures on the Eurex exchange, and compare with similar products on CME.

Read MoreAugust 25, 2011 - The Treasury futures roll occurs quarterly with the March, June, September, and December delivery cycle of Treasury futures contracts.

Read MoreMay 26, 2011 - We track 62 unique macroeconomic events and calibrate our volume forecasts to the effect of each data release.

Read More