Feb 24, 2022 - Given the profound changes in microstructure variables and the rise of algorithmic trading over the years, we study changes in the trade size clustering across active contracts (ES and ZN) using ten years of data.

Read MoreFeb 16, 2022 - As we embark upon the rates futures roll-period, we analyze the mid-month changes in the microstructure variables of the rates futures and compare the same against the previous roll periods.

Read MoreFeb 3, 2022 - Our findings include the recent month’s averages of rates and equity index futures and their deviations from December 2021 and the previous 3-years.

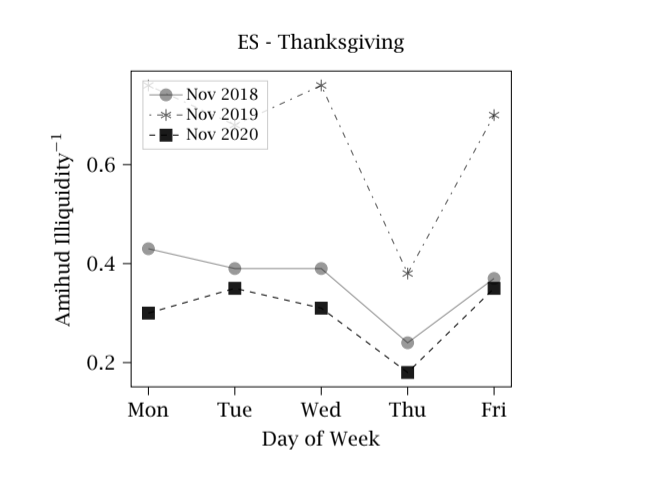

Read MoreNovember 23, 2021 - We look at market data on Thanksgiving and Christmas in the past few years to examine liquidity around the holidays.

Read MoreNovember 17, 2021 - In this paper, we review our treasury roll forecast accuracy from Aug 2018 until now.

Read MoreOctober 2, 2021 - In this paper, we highlight the production performance of the CLOSER algorithm specific to Cash Treasury.

Read MoreSeptember 10, 2021 - This paper presents a follow-up simulation experiment with a significantly larger parent order size to support our previous finding in Improvements on QB’s Closer Strategy.

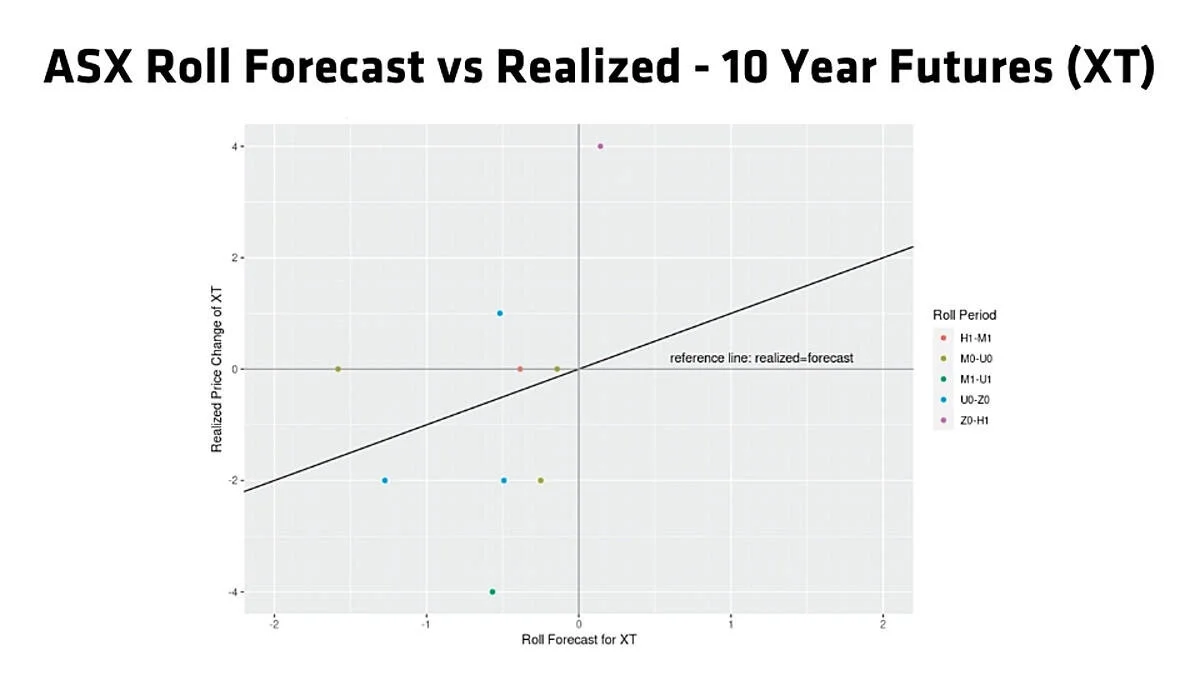

Read MoreAugust 11, 2021 - We examined the accuracy of our forecast for the 10-year (XT) and 3-year (YT) Australian bond futures traded on ASX for the past five roll periods. The forecast was 89% accurate for the 10-year and 78% accurate for the 3-year bond future.

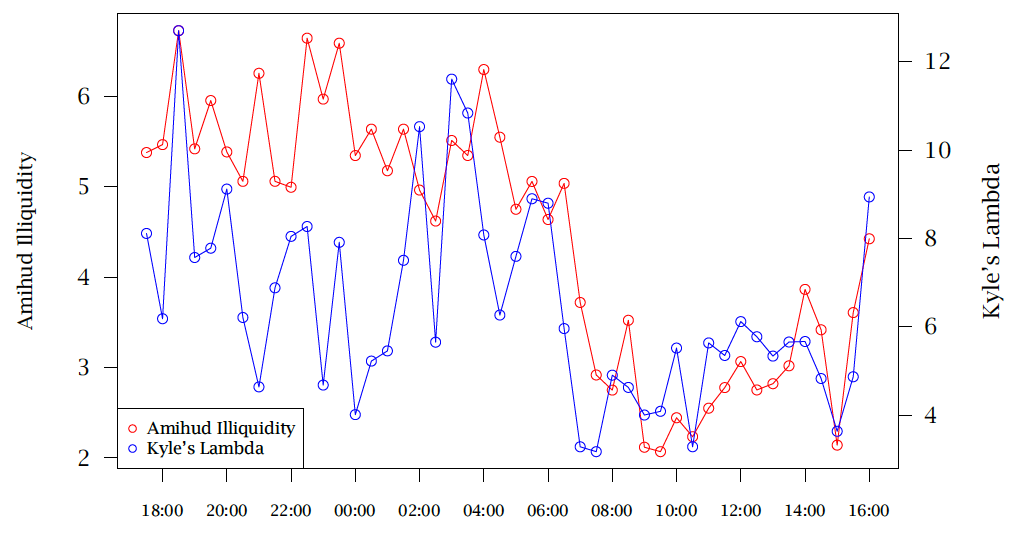

Read MoreAugust 2, 2021 - This research analyzes the intraday liquidity profiles of three yen-denominated Nikkei225 equity index futures listed on three different exchanges: CME, SGX, and JPX.

Read MoreJuly 21, 2021 - We examine the relationship between trading costs and price levels with our order-level data and find our cost model robust to price levels.

Read MoreJune 24, 2021 - The purpose of this paper is to show how we adjusted our volume profiles for the upcoming Russell rebalance day on June 25th, 2021.

Read MoreJune 22, 2021 - In our recent whitepaper “Intraday Liquidity Profiles of Bitcoin Futures and Micro Bitcoin Futures” we analyzed the intraday profiles of BTC futures and compared them against the liquidity of the MBTC.

Read MoreJune 7, 2021 - In this whitepaper, we show the Bayesian adjustments and the results of our volume forecast model to accommodate the shift in benchmark timing for Bloomberg Barclays US Aggregate Bond Index.

Read MoreMay 10, 2021 - In this whitepaper, we examined the changes in the microstructure of STOXX Banks futures (FESB) to analyze the potential impact of the tick size reduction of STOXX 50 futures (FESX).

Read MoreApril 7, 2021 - In this paper we examine the impact of tick size changes on Eurex DAX Index Futures (DAX) outrights’ microstructure variables.

Read MoreMarch 24, 2021 - In this paper we measure schedule-based algo execution performance by looking beyond slippage against benchmarks, and trading speed metrics, in order to verify if the realized schedule was fast or slow.

Read MoreFebruary 23, 2021 - In this paper, we describe our machine learning technique of an unsupervised Neural Network method to cluster instruments.

Read MoreJanuary 25, 2021 - In this paper, we present a regression-based methodology to improve the volume predictions during the continuous hours and specific events such as the settlement window.

Read MoreJanuary 26, 2021 - In this paper, we outline our approach to adjust for the end of the month days for the 10-year and 30-year Cash Treasury. The method is similar to other instruments as well.

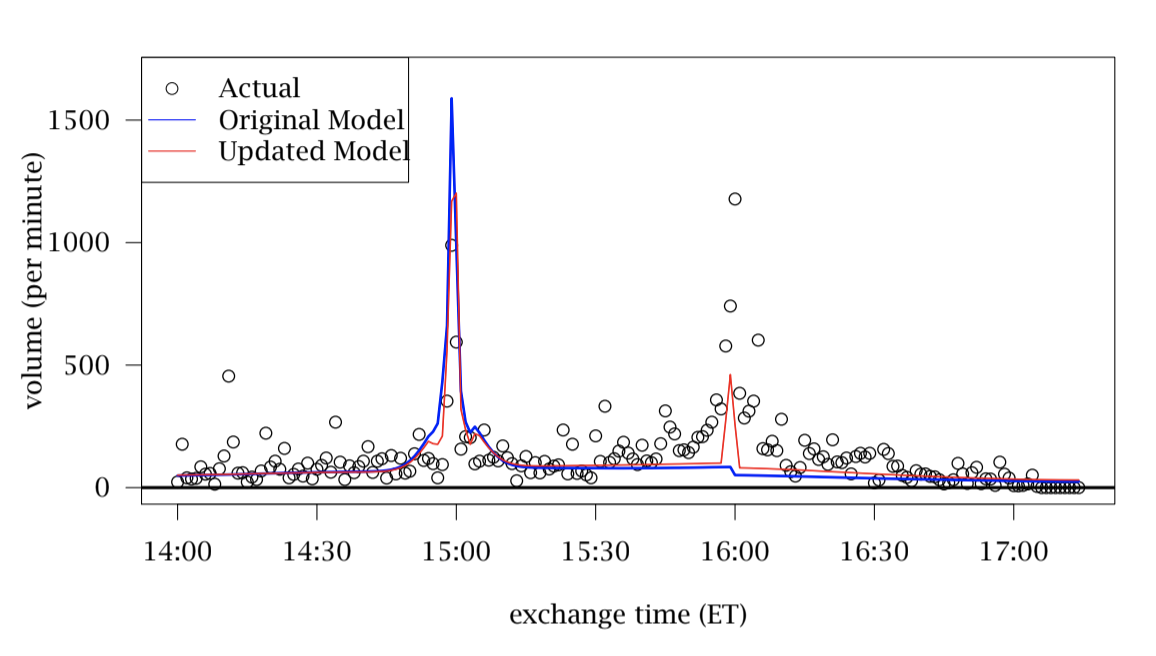

Read MoreDecember 22, 2020 - This paper summarizes recent updates on three key components of the Closer algorithm. QB's Closer is an alternative way of targeting settlement price. The Algo incorporates an intelligent combination of price and volume forecast along with an optimization technique for order placement.

Read More