The Rise of Bitcoin Derivatives

In recent months, Bitcoin and other cryptocurrencies have met a renewed investor confidence, followed by volatility, uncertainty, tweets, and more volatility. During the COVID-19 pandemic, Bitcoin reached record prices and became the topic of conversation at the dining tables around the world. Over the years, there have been skeptics and critics, but since the release of Bitcoin (BTC) and Micro Bitcoin (MBTC) Futures at the CME, the crypto can now be used as a strategic financial product with growing monthly volume.

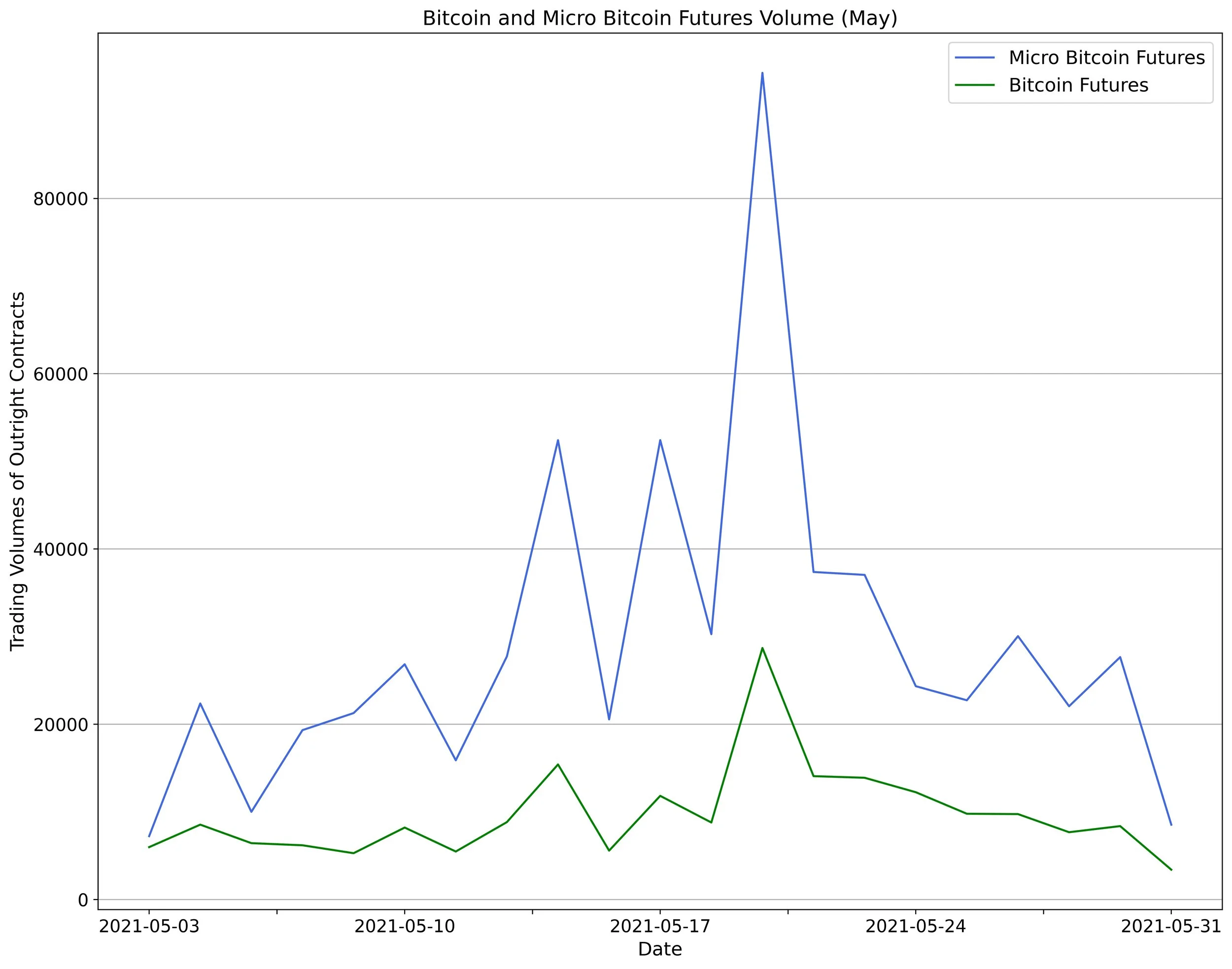

The discussions about Bitcoin and its derivatives’ uses are still in their infancy, but adoption of this new asset class is happening fast. As an execution business, we have also seen growing demand from our clients for execution solutions and quantitative research where there previously were none. We are happy to announce QB now supports CME’s Bitcoin and MicroBitcoin futures contracts and published a whitepaper where we analyzed the intraday profiles of BTC against MBTC futures.

QB Whitepaper - “Intraday Liquidity Profiles of Bitcoin Futures and Micro Bitcoin Futures (June 2021)

As institutional investors adopt cryptocurrencies, many will likely continue to use synthetic exposures and derivatives to the assets instead of participating in the outright spot or cash market to avoid retail-driven volatility. Separately, there are other considerations, such as counterparty risks, as many of the cryptocurrencies are not listed in traditional exchanges. With the rise of new exchange-traded products (ETPs), there could be an opportunity for more institutional investors to participate in this market in the coming months. In February, Canadian regulators approved the first bitcoin ETF on the Toronto Stock Exchange, and the US could follow soon.

The rise in crypto products, hedge funds, exchanges, and platforms have given access to institutional and retail clients alike, however risk appetite in the crypto markets varies and during moments of deep riskoff (looking at May-June 2021), it makes us reconsider if bitcoin is actually the modern gold standard. We wrote about Bitcoin in 2017 in our blog: “Bitcoin: To Infinity Or To Reality?” and we stand by our view, cryptocurrencies are still an evolving market with a lot of potential.

Bitcoin could be replaced over time or find an equivalent contender, and transitions take time. If you recall, most people did not switch from traditional newspapers for podcasts and blogs overnight. At QB, we are futurists, and we like to imagine cryptocurrencies as the tip of the iceberg, the next frontier towards a more digital, modern and transparent financial market. The intrinsic value of crypto is the hope that it could become the next best thing since the internet.

Quantitative Brokers

June 24, 2021

New York, NY