In 2008, our founders saw a better way to trade FICC products

Electronic trading for Fixed Income Commodities and Currencies was not efficient- The journey to intelligent execution began when Dr. Robert Almgren and Christian Hauff while working together at a major bank concluded that fixed income traders were lacking efficient technology solutions, quantitative execution, and cost measurement tools which had been so valuable for the equity markets.

So our founders set out to create something different —After 2 years of R&D, Quantitative Brokers (QB) was born and executed its first client trade. Since then, QB has helped further democratize access, enhance workflow and transparency for our clients.

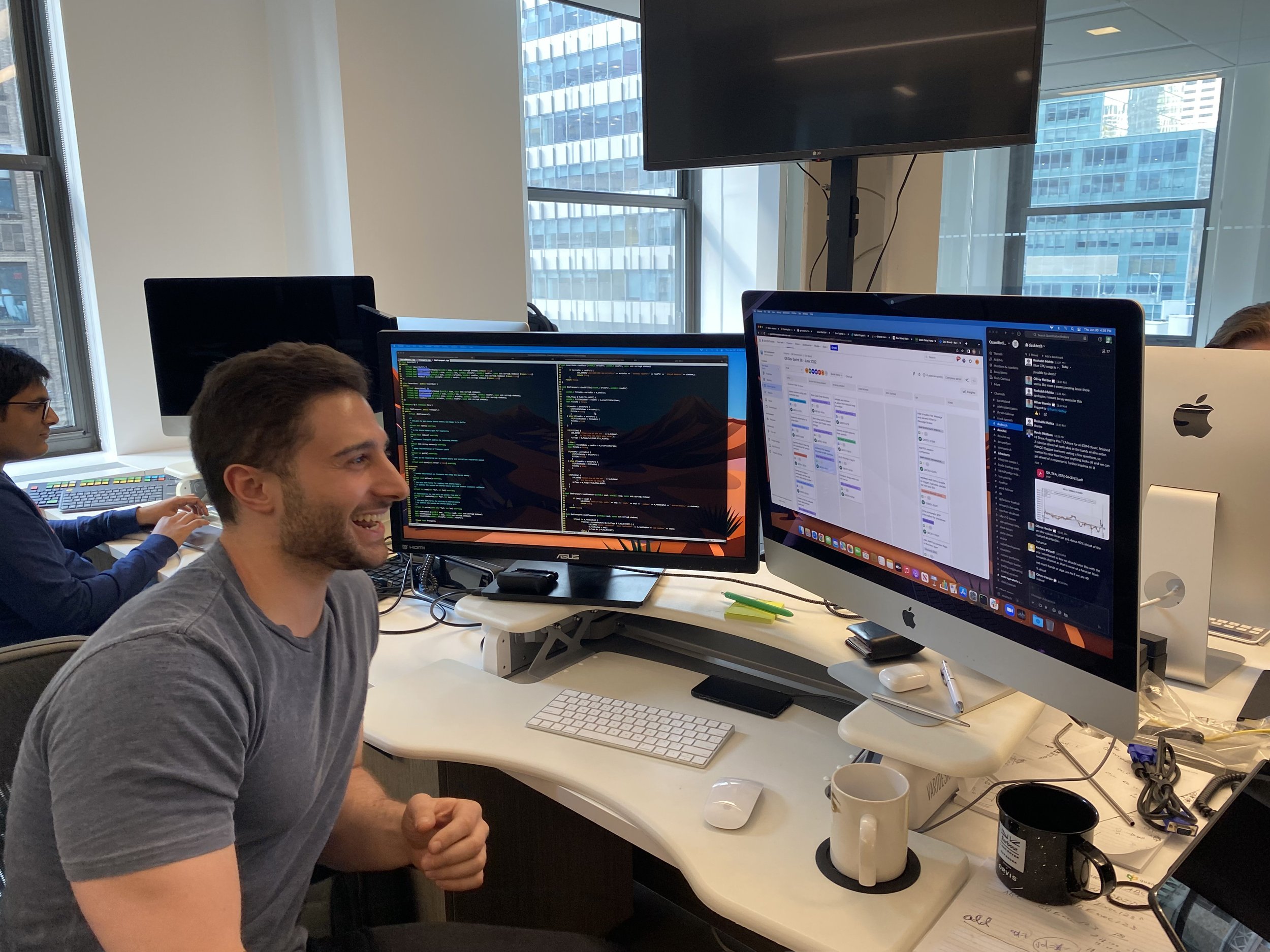

QB now has a suite of seven algorithms, four offices worldwide, and 70+ employees. Our client base includes the world's biggest asset managers, hedge funds, CTAs, global banks, public and private companies including the buy-side and sell-side.

We are a research-driven company, specialists in market microstructure and algorithmic engineering. Trading performance is our main focus, it is met with a delicate balance between our proprietary signals, market microstructure research, and QB’s trading engine. The algorithms can be changed in response to market conditions, volatility, and client feedback.

“Our advances in execution analytics and technology have saved our clients hundreds of millions of dollars in transaction costs over the past decade. We will continue to be driven to advance the frontier of algorithmic execution to reduce trading costs for all clients while delivering high-quality service and market execution every step of the way.” Dr. Robert Almgren., Chief Scientist and Co-Founder

QB currently has seven algorithmic strategies - covering over 20 global exchanges and 130+ contracts. QB designs strategies for addressing certain objectives and all of the details about how to manage the distinctive characteristics of the market. Each algo is born out of a deep conversation with clients. Whenever we release an algo it is optimized for a specific objective and our benchmark is the performance metric the algo targets to minimize slippage and maximize alpha.

“Our impressive team of engineers, quants, developers and practitioners continually advance the QB offering and are already building the next wave of best execution innovations.” Christian Hauff, CEO and Co-Founder

QB is an outsourced quant execution firm, a cross between a brokerage, a FinTech, and an analytics vendor. We are a registered broker-dealer and FINRA & NFA Licensed.

QB is a neutral technology provider and works with all major executing brokers, clearing brokers, and FCMs. We are also front-end agnostic, we are already integrated with many EMS/OMS providers and we are constantly working with their technology teams to maintain and enhance our interface compatibility.

Learn More About

Algorithmic Execution with QB

Quantitative Brokers is broker and front-end neutral. We integrate with our clients' preferred workflow so there is no need to change. By embracing intelligent execution algorithms you can achieve better execution and improved productivity.